Verify Employment After Closing

The call is documented and your employment is confirmed with the employer. Although lenders sometimes disclose at the time of application that employment assets and credit may be reverified near or on the closing date.

5 Things Not To Do During The Closing Process Changing Jobs Bright Minds Closer

But opening a new line of credit or even closing one can cause a disruption in your existing credit.

Verify employment after closing. This letter is to verify that Robert Smith was employed at Martin Martin Incorporated from January 3 2017 to March 1 2020. Once you click Close Case you may select an option indicating you are closing the case because information was entered incorrectly. The Reason Lenders Verify Employment.

Do not open a new credit. This may be nothing more than a Post Closing Audit. Days after I was let go the company was bought out.

After all the loan has already been approved. Lenders may call your employer to verify that your employment is secure They might double-check. They normally verify employment within 1-2 days before closing and will make you sign documents that will allow them to do it within 60days after closing if you dont tell them then youll have a problem where you can lose the new home and will be required to pay in full the whole mortgage balance.

Mortgage lenders verify employment as part of the loan underwriting process usually well before the projected closing date. In your case i would have to think that the lender knew the circumstances surrounding your employment - they would have done a verification prior to closing. Your employer is called no more than 10 days before the loan closure or 120 days if youre self-employed.

The same information can be obtained from the Social Security Administration. Employment Security records. It is common for quality control to pull a sampling of loans to audit in order to assure Secondary Market Investors Fannie Freddie that the loans being closed and delivered to them meet ALL Underwriting guidelines and Fed Lending Disclosure Laws.

An underwriter or a loan processor calls your employer to confirm the. When applying for jobs I gave out HRs info for verification. If you require any additional information regarding Robert Smith please feel free to contact me at 555-765-4321.

Close the case only after E-Verify provides a final case result or if you no longer need to continue to confirm the employment eligibility of the employee. If youre not sure what the recruiter will ask for bring documents that verify you were an employee of the company before it closed. Employment verification 3 months after closing.

By completing this form people can obtain copies of their in-state employment. If conditions of employment exist the lender must confirm prior to closing that all conditions of employment are satisfied either. Keep the documents in a folder and present them if the.

Job Loss After Mortgage Closing. The HR department is the department that will do verification of employment. Expect a verbal verification of employment and more.

The lender is trying to determine borrowers have a solid job and income will be secure for the next three years. I would NOT quit til your loan is recorded. There are two types of VOEs.

IF EMPLOYEE WILL NOT TAKE ACTION TO RESOLVE THE TNC. Employment Verification for Past Employee. Defining the Verification of Employment.

Verification of employment often referred to as VOE is done during the mortgage process. The Verification of Employment is a way for the lender to ensure that you are. So that is AFTER you sign your closing docs.

It might seem crazy for a lender to verify something you already provided them. Most employers have an HR department. Which is generally 48 hours after funding.

Written VOEs and Verbal VOE. I worked for a friend of mine for a couple of years she closed the business due to a surgery but I wrote down her home number for a potential employer to. Importance Of Verification Of Employment There is a reason why underwriters want to see two-year employment history two years of tax returns two years W-2s most recent 30 days paycheck stubs and verification of employment.

If youre self-employed youll be much more involved in the verbal verification of employment process. MOST lenders i deal with do a verification of employment within 5 days of funding. Clearly identify the terms of employment including position type and rate of pay and start date.

The lender contacts the borrowers employer and verifies the employment and payroll information of the borrower. Even if an employee no longer has their W-2 they can still get access to their employment records by contacting Employment Security. You might be tempted to open a new credit once you have closed on a mortgage loan.

Post-closing departments will at least occasionally confirm aspects of the file such as employment. This is another item on what not to do after closing on a house. The loan is closed and delivered.

Some HRs simply can not verify employment if the company has closed. Do Lenders Verify Employment the Day of Closing.

Pin By Gvanwage On Lawyers Title Frisco Tx 75034 Dfw Real Estate Mortgage Companies Title Insurance

Contract To Closing Key Players And Their Responsibilities Infographic Sarasota Real Estate Www Real Estate Contract Real Estate Terms Real Estate Advice

Costum Previous Employment Verification Letter In 2021 Letter Of Employment Letter Templates Job Letter

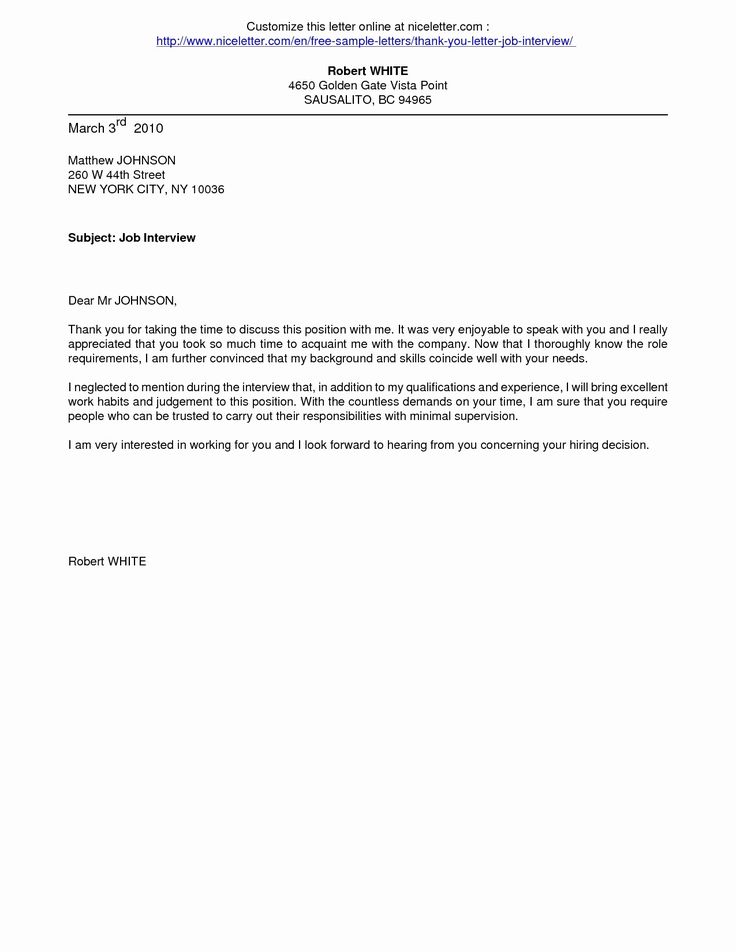

50 Thank You Letter To Buyer After Closing Wc3k

14 Real Estate Letter Of Intent Templates Free Sample Example Format Download Letter Of Intent Letter Example Introduction Letter

During The Closing Process Your Credit Will Be Checked Multiple Times So It S Real Estate Marketing Tools Real Estate Infographic Real Estate Marketing Plan

Employment Verification Letter Sample Lettering Letter Of Employment Letter Sample

5 Steps To Successfully Get Your Home Loan Loans Box Tips On Loans Singapore Home Loans Loan Home

What You Need To Know About The Mortgage Process Infographic Mortgage Infographic Mortgage Process Real Estate Buyers

13 Resume Examples Australia First Job Resume Template Australia Job Resume Template Letter Templates

Fha Streamline Refinance Offers Are Real And Worth Exploring Fha Streamline Refinance Refinance Mortgage Fha Streamline

House Purchase Offer Confirmation Letter How To Create A House Purchase Offer Confirmation Letter Offer And Acceptance Letter Templates Confirmation Letter

Loan Application Letter Loan Application Letter Is Written To Ask For Monetary Credit Service On Some Kind Of Secured Mortgage Basis

Sample Job Cover Letters Job Application Letter Cover Letter For Resume Sample Resume Cover Letter Job Cover Letter

What Does A Real Estate Agent Do For A Seller Real Estate Agent Estate Agent Real Estate

Pin On American Pacific Mortgage

Employment Verification Letter Template Letter Template Word Letter Of Employment Employment Letter Sample

Post a Comment for "Verify Employment After Closing"